On 5th August Leeds United announced that they were joining a growing a number of clubs offering the Socios so called fan engagement token. The Leeds United Supporters Network have researched this product and liaised with the club over our worrying findings.

Labelled as fan engagement, Socio’s appears to be anything but. It prays on loyalty to our club, can create damaging addictions, lose supporters money, but could make fortunes for professional gamblers with wild swings in the value of the Cryptocurrency that underpins the scheme.

The regulator of financial products in the UK, the Financial Conduct Authority, although not able ‘currently’ to regulate cryptocurrencies, issued a stark warning in a fact sheet, (1)

this is a ‘very high risk, speculative investment’ ‘ Be prepared to lose all your money’

The Governor of the Bank of England too, Andrew Bailey commented ‘I am going to say this very bluntly. Buy them if you are prepared to lose all your money’ before observing that he didn’t think that they would last. (2)

The Treasury identified several risks to the consumer, of unsuitability, large losses, exposure to fraud and the failings of providers.

Outside the field of finance Castle Craig who run world renown rehab clinics for addiction said that Crypto currency dealing had the same behavioural addiction hallmarks as problem gambling with all the resulting issues for finance, families, and health (3)

Even the Advertising industry, who desperately need new revenue streams, said that ‘given target audiences lack of financial savvy there is perhaps an even greater need than usual to present campaigns as scrupulously and accurately as possible’ (4)

something that hasn’t been apparent in most clubs marketing of the product.

Arsenal describe it ‘just like buying foreign currency for your holidays’. It is not.

Currencies move in small percentages, Chiliz, the underlying cryptocurrency has moved 40% in a day. There is little stability in the values of cryptocurrencies compared to the stocks and shares, foreign currency or even commodities such as oil. They are far more volatile. Chiliz, registered in Malta, is quite a small player in the market, further increasing the possibility of rapid movement.

Cryptocurrencies have been targeted on the younger generation often through influencers or trusted organisations. A ‘Save the Kids charity’ cryptocurrency was promoted by a number of influencers with over 50 million followers such as the FaZe Clan. Coffezilla, a youtuber, dedicated to evidencing online scams, revealed that the currency tanked by 50% two minutes after it launched, and the investors ended up losing virtually all their money. ‘It was a premedicated scam’ he commented (5)

Perhaps the last word in risk comes from Chiliz itself in its white paper or prospectus (6)

‘if any of the risks mentioned in the terms are unacceptable or the participant is not in a position to understand, the participant should not acquire, hold or use chiliz’

Socio’s identified many risks with their own product

In the case of loss there is no investor compensation scheme.

It is difficult to predict how and whether regulations will be applied, with a very pointed warning ‘that the company may cease trading if regulations may make trading commercially undesirable’.

There is of course a distinct prospect of this occurring, Standard Life/Aberdeen, the country’s largest asset management company with £535 billion under management believe that policymakers will act to stop widespread adoption of alternative currencies (7)

Regulation often starts with strict rules on marketing and advertising, and we know that both the Financial Conduct Authority and the Advertising Standards Authority are looking at this.

Taxation rules are uncertain and buyers are advised by Chiliz to get independent tax advice.

There are risks with the failure of hardware, software, internet connection, money laundering, fraud and exploitation for illegal purposes (8)

Unfortunately, none of these risks identified by Socios/Chiliz have been passed on by the club to the supporters, it is hoped that this may come with the launch, of course. Perhaps the Chiliz sales pitch glossed over the risks to fans in favour of the benefits to the club.

This is a far cry from the glamorous concept of radical fan engagement with a crowd control engine giving fans voting rights to guide the favourite team’s management and strategic decisions. Indeed, fan engagement is very low amongst those entitled to vote, less than 15% and sometimes below 10% (9). This would suggest that the purchase of tokens is little to do with engaging with the club but speculation.

Perhaps the basis of this can be seen by looking at the named executives, advisers, and investors in the Chiliz prospectus. Possibly ten are professional poker players, including the CEO of Socios Alexandre Dreyfus (10), but only one has declared a financial services background. It’s a bit like asking Bet 365 to design a bank account.

It appears to be a western street front of respectability pulling in the unwary but hidden behind is a raucous gambling den with marked cards. Venture in there at your peril.

One of the four named investors stands out to football fans, Dr Stanley Choi, he of Wigan Athletic fame. Choi sold Wigan to Next Leader Fund, Choi’s company IEC lending them the money to acquire it, who then, only two weeks later, put Wigan into administration, ensuring with the points deduction that they were relegated (11)

Wigan were 16th at the time they went into administration.

Rick Parry of the EFL speculated that there had been a massive bet in the Philippines that Wigan would be relegated (12)

Wigan had certainly been mired in rumours of betting scandals for a number of years (13). It is maybe coincidental that Choi is a top poker player, once winning $6.5 million in the Macau High Stakes Challenge and owning Casino’s in the Philippines (14). He never attended a Wigan Board meeting such was his interest in football (15)

and yet seemingly he wants to invest in a scheme that promotes ‘fan engagement’ something that was sadly lacking from his time at Wigan.

The investors and the owners seem to hold most of the cards in this Socio’s scheme, 91% of Barcelona’s tokens, 81% of Juventus, 65.7% of Atletico are owned by one source (with cryptos there is no openness of ownership as with a PLC) (16)

When trading volumes increase the stock is dumped such 400000 PSG on the rumours of Messi joining (17). The more ordinary fans join the higher the trading volumes. It’s akin to a pyramid scheme. At every twist and turn the app encourages the purchase of more tokens, more cryptocurrency, higher trading volumes, the more of the reserve that can be injected into the system. Joey D’Urso article for the Athletic suggests that Socios have liquidated $80 million since March. (18)

As an unregulated product there are no rules on insider trading or market abuse (19)

as there are with shares. Some Executives and Directors could take advantage of prior knowledge of transfer deals to gain personally as such a scheme spreads rapidly across the football community.

The Leeds United Supporters Network has for the last few weeks pointed out these issues privately to the club and recommended that it shouldn’t be launched as happened with West Ham (20)

but if the club were unable to withdraw from the scheme for contractual reasons, how they should ensure that the product is correctly targeted on those that can understand and accept the risk.

The club gains from a commission on each trade, which allegedly is very lucrative. There are unsubstantiated rumours of up to 50%, however Socio’s claim that £73million have been paid to its partners (21). We have pointed out to the club the dangers of marketing an unregulated product, when the club itself is regulated by the FCA and how that this historically has caused reputational damage and large compensation bills to many high street names. (22)

There is a possibility of damage to the club’s standing as well as possible compensation for mis-selling, Certainly West Ham thought there was.

This product could therefore be seen as a danger, not only to the vast majority of supporters but also to the club itself. The Leeds United Supporters Network, having engaged with leading experts in the field of cryptocurrencies, felt that, for reasons of commercial sensitivity, the club should be advised, confidentially, of its research with the hope that the scheme would be shelved or correctly targeted.(23)

However, we have not received any such assurances and therefore it is important to say to our members that we do not feel that this is a product that should be bought by the broad fan base without full knowledge and understanding of the risks of crypto currencies. If any supporter is tempted, the regulatory publications should be referred to, expert advice taken from an Independent Financial Adviser and the taxation aspects looked at by a Chartered Accountant.

There is a wider concern that this is just the start. The loyalty that supporters have to the club and their trust in the current directors make them a lucrative target market for not just the unregulated cryptoasset market but also the risker areas of financial service products too.

Leeds United Supporters Network

- Research 19/08/21

Sources

1- FCA Factsheet www.fca.org.uk/consumer/cryptoassets

2- Andrew Bailey Press Conference CNBC 07/05/2021- Bailey also warned he didn’t feel the market would last. He contrasted the movements in forex and oil prices against bitcoin.

3- Castle Craig -castlecraig.co.uk- Guide to cryptocurrency addiction- They believe that it becomes a problem for 9 in every 1000, but also 70 invest at levels that could be very risky and may lead to difficulties. Therefore, for every 50000 fans it will be a serious problem for 450, and potentially for another 3500.

4- The Drum -Emma McInnes August 6th 2021-Why marketers must be wary of targeting the cryptocurious.

5- Nbc Inside the wild west of Cryptocurrencies and Faze Clan & Ricegum Promoted Scams for Kids - YouTube.

6- Chiliz whitepaper- CHZ_whitepaper.pdf (chiliz.com) page 59 reference to Dr Stanley Choi

7- Aberdeen/Standard Life Briefing note 17th August 2021

8- BBC- Hackers steal $600 million in major cryptocurrency heist 12th August 2021

9- @uglygame Martin Calladine

10- www.thehendonmob.com list of the worlds top poker players

11- Thepieatnight.co.uk 19/06/20 quoting Phil O’Brien Choi was a majority shareholder in the new owners but stepped back. His other company IEC lent the new owners £24.36 million at an interest rate of 8% rising to 20% after six months.

12- Independent -Mark Critchley 3rd July 2020 . EFL chairman Rick Parry secretly filmed discussing Wigan relegation and a bet in the Philippines.

13- cardschat.com Daniel Smyth ‘Stanley Choi considered key player in Wigan Athletic Administration Controversy’. It was alleged that in 2019 a wired spectator had been removed from the ground linked to betting in Hong Kong. NFL was set up in the Cayman Islands in Jan 2020 at the time Choi was the major shareholder.

14- www.thehendonmob.com list of the worlds top poker players includes the CEO of Chiliz.

15- The Athletic Adam Crafton 04/07/20- How Wigan were torn apart by invisible owners

16- @uglygame Martin Calladine Chiliz drops 40% on May 18th 2021

17- Ibid

18- The Athletic Socio’s fan tokens-what they really are and how they work-special investigation by Joey D’Urso Aug 18 2021.

19- Insider dealing is a criminal offence under part v of the Criminal Justice act 1993, and criminal market manipulation is an offence under sections 89-91 of the Financial Services Act- Reference FCA paper Market Abuse. There are no such rules on cryptoassets.

20- The Athletic Socio’s fan tokens-what they really are and how they work-special investigation by Joey D’Urso Aug 18 2021.

21- Ibid

22- PPI was an unregulated product often sold by companies who were regulated. A common law decision declared that high levels of commission meant that the contract was illegal counter to the defence that it was an unregulated product so there were no rules. Compensation totalled £38billion. The FCA now hold senior management to account for the sale of unregulated products expecting high standards to apply. In addition, financial promotions must be fair and not misleading, giving a balanced impression of the product and must not disguise or diminish. This is not apparent in the Socio’s marketing so far. Both the FCA and the ASA are looking at the marketing of these products.

23- Emails 8/08/21 09/08/21 and 13/08/21

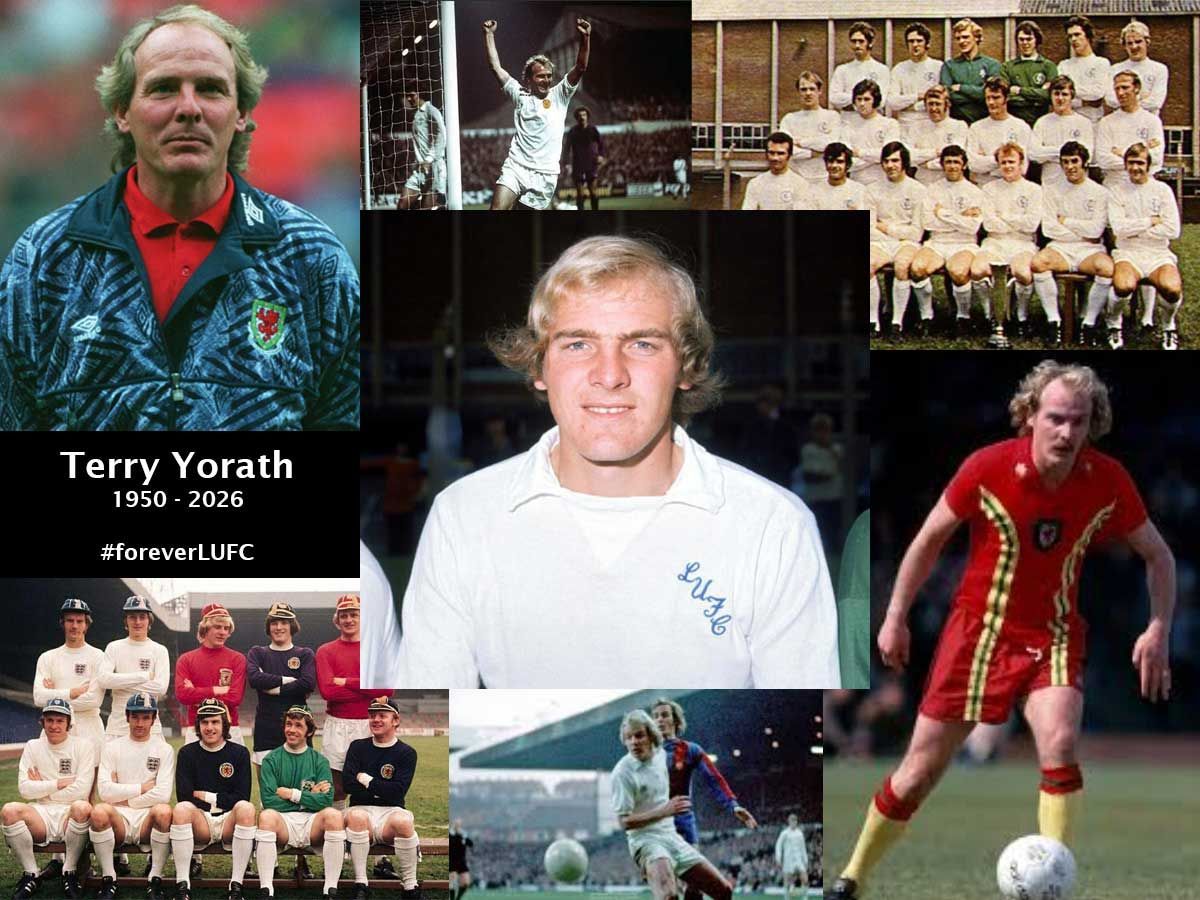

The Leeds United Supporters’ Network is deeply saddened to learn of the passing of Terry Yorath, aged 75. Terry was a proud servant of Leeds United , a former Wales captain and manager, and a respected figure in football both on and off the pitch. Our thoughts are with his family, friends, and all who knew him. Terry emerged as a strong, natural leader in Don Revie’s great Leeds United side of the early 1970s. Although born in Cardiff, Wales, he signed as a schoolboy, and went on to play a key role in the 1973–74 First Division title-winning team and featured in the 1975 European Cup Final, becoming the first Welshman to play in that competition’s final. He later enjoyed distinguished spells with Coventry City and Tottenham Hotspur, captaining Coventry with pride, and represented Wales with great commitment, earning 59 caps. Beyond his playing days, Terry gave much to the game as a manager, most notably with Wales, where he led a talented side that came heartbreakingly close to qualifying for the 1994 World Cup. His life was marked by personal tragedy, including the loss of his son Daniel and his presence at the Bradford City fire, events that showed his courage and humanity away from football. Terry Yorath will be remembered by LUSN members, and Leeds United fans everywhere, as a fierce competitor, a leader, and a man who represented our club with honour. As with all our legends, he will never be forgotten.